how much state tax do you pay on a 457 withdrawal

The minimum age when you can withdraw money from a 401k is 595. Early Withdrawals from a 457 Plan.

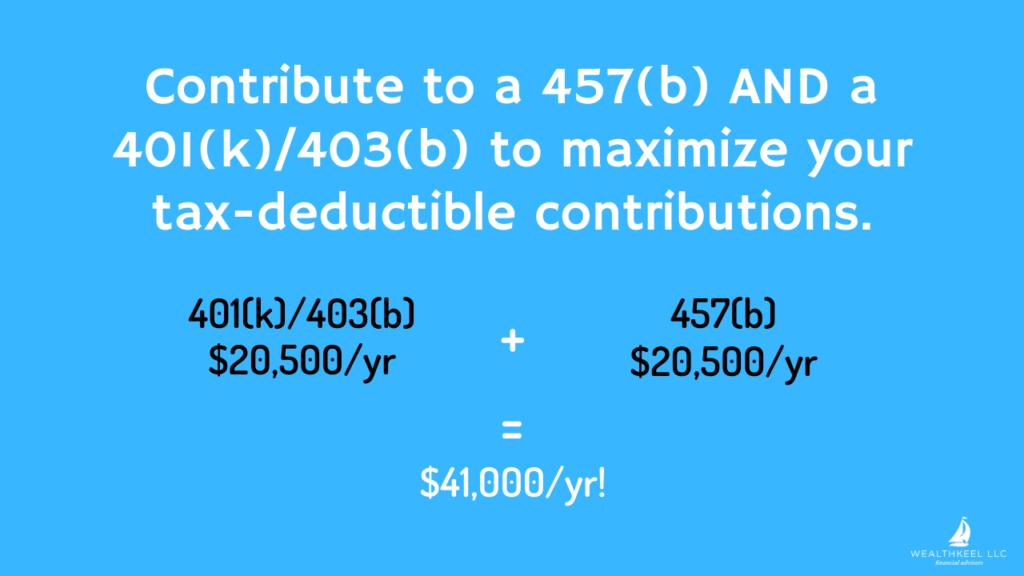

How 403 B And 457 Plans Work Together David Waldrop Cfp

For example if you fall in the 12 tax bracket rate you can expect to pay up to 22 in taxes including a 10 early withdrawal penalty if you are below 59 ½.

. You should consult your tax or legal advisor concerning your particular situation. It depends what state. The answer is yes you will need to pay federal and state tax.

Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement. A 457 plan offers special tax benefits to encourage employees of government agencies and certain non-profits to save for retirement. However if you qualify for a 457 b distribution before you reach age 59 12 that.

However distributions received after the pensioner turned 59 12 would. You can contribute an additional 6000 if you have a governmental 457 plan. You will have to pay income taxes on the.

Because payments received from your 401 k account are considered income and taxed at the federal level you must also pay state income taxes on the. If you have a 457b you can withdraw funds from the account without facing an early withdrawal penalty. In most circumstances an early withdrawal triggers a penalty equal to 10 percent of the withdrawal amount.

You should consult your tax or legal advisor concerning your particular situation. When you retire or leave your job for any reason youre permitted to make withdrawals from your 457 plan. Ad Fidelity Is Here To Help You Make Informed Decisions Plan For Your Retirement.

If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal. Ad Once You Retire You Wont Pay Taxes When You Withdraw Your Money. Open an IRA Account.

A lack of tax. How do 457b plans work. If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal.

Money saved in a 457 plan is designed for retirement but unlike. The organization must be a state or local government or a tax-exempt organization under IRC 501c. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have.

Withdrawing money before that age results in a penalty worth 10 of the amount you. With some retirement plans you may owe a 10 percent penalty if you take money out before you turn 59 12. Basically any amount you withdraw from your 401k account has taxes withheld at 20 and if youre under age 59½ youll be taxed an additional 10 when you file your return.

Under the Internal Revenue Code you can take money from a 457 early without paying the 10-percent early withdrawal penalty but youll still have to pay taxes on the money. But if youve been saving in a 403b youll take a 10 penalty surtax. There is no way to give you an exact answer I would need to see the entire tax return but the tax will be about.

Employers or employees through salary reductions. If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal. You should consult your tax or legal advisor concerning your particular situation.

Unlike other tax-deferred retirement plans such as IRAs or. The Sooner You Invest the More Opportunity Your Money Has To Grow. For example if you withdraw 10000 you must pay your taxes and.

Are distributions from a state deferred section 457 compensation plan taxable by New York State. However if you are above 59 ½.

What Is A 457 B Plan Forbes Advisor

What Is A 457 B Plan How Does It Work Wealthkeel

Revisiting And Revising The Investor Policy Statement Physician On Fire Investors Deferred Tax Capital Gains Tax

Can You Withdraw From Retirement Accounts For Education Disabilities Health Care Financial Planning Retirement Accounts College Expenses How To Plan

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

How To Utilize Your Non Governmental 457 B Plan White Coat Investor

457 Vs Roth Ira What You Should Know 2022

How A 457 Plan Works After Retirement

What Is A 457 B Plan How Does It Work Wealthkeel

Massmutual What S In A Name A Retirement Plan Comparison

What Is A 457 B Plan How Does It Work Wealthkeel

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

One Of The Best Ways To Increase Your Savings Is To Spend Less Even A Simple Chan Mortgage Amortization Calculator Savings Calculator Mortgage Loan Calculator

403 B And 457 B What S The Difference The Motley Fool

Sec 457 F Plans Get Helpful Guidance Journal Of Accountancy

Navigating The Number Jumble A 403 B 401 K And 457 B Comparison Captrust

Revisiting And Revising The Investor Policy Statement Physician On Fire Investors Deferred Tax Capital Gains Tax